“The Big Short” is up for several Oscars this weekend for portraying how a small group of savvy investors shorted the mortgage market by correctly predicting the collapse of the housing bubble in 2006.

But while Hollywood is focused on the Oscars, investors are buzzing for another reason. Michael Burry, played by Christian Bale in the movie, ends the film by declaring his next big move: water. You could call it his “big long.” The world’s freshwater supply is under increasing demand, and he’s betting prices will rise dramatically in the coming years.

Burry told New York Magazine in December:

This idea that food is virtual water was spotlighted in one of our recent Reveal episodes. Ike Sriskandarajah and I reported on a Saudi dairy company growing hay in the Arizona desert and shipping it back to Riyadh, doing exactly what Burry described. You should give it a listen if you haven’t yet. We talk to a Saudi banker who describes the concept of virtual water and shows how Saudi Arabia is effectively importing hundreds of oil drums of water with every bale of hay.

It’s a phenomenon happening around the world as investors and governments looking to secure adequate food supplies become more focused on freshwater. The organizers of the world’s largest agricultural investment conference have made it the focus of this year’s event in New York in April, telling attendees, “Water risks pose a growing threat to the food sector, and are causing real financial impacts for companies.”

The threat to the world’s freshwater largely is driven by three factors: pollution, growing demand and climate change. Politicians might debate the merits of at least two of those factors, but investors don’t.

In August, a group of 60 investors collectively managing $2.6 trillion in assets sent some of the world’s largest food companies open letters demanding that they take immediate action to better manage threats to the world’s freshwater supply because, if they didn’t, companies such as Hormel Foods Corp. and Tyson Foods Inc. could suffer severe financial damages as their ability to produce food plummets.

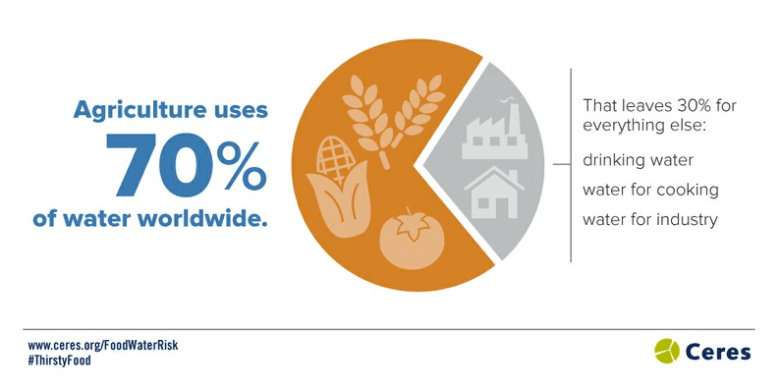

Food producers account for about 70 percent of the freshwater used each year. Shortages as a result of climate change, pollution or spiking demand would result in massive financial losses if companies aren’t prepared.

For many people, the impact wouldn’t be financial – it would be to their health. Water shortages would result in spiking food prices and, in developing countries in Africa, Southeast Asia and Central America, it would mean more malnutrition, starvation and death.

Nathan Halverson can be reached at nhalverson@cironline.org. Follow him on Twitter: @eWords.